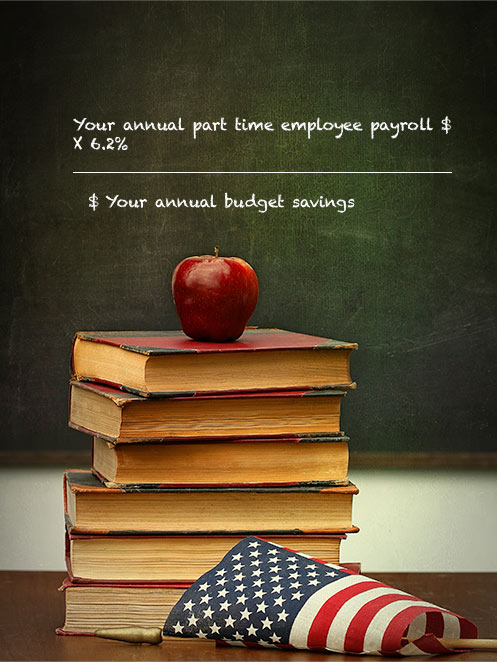

FICA Alternative (or OBRA) Plan

As an alternative to Social Security, the FICA Alternative Plan provides an individual investment plan for part-time, temporary and seasonal employees. Contributions to the plan are deducted from each employee’s wages and are income tax-deferred and invested in accordance with each employee’s direction.

Benefits of a BENCOR FICA Alternative Plan:

Meet John. John is a part-time employee for his local school district. Because his school district has a BENCOR FICA Alternative Plan, he now has a contribution going into his retirement plan in his name with no impact to his take-home pay, a benefit he would not have had otherwise. Here is how the plan works:

Without BENCOR

| John’s Gross Pay: $1,000 | |||

| Retirement Savings | Social Security Tax (6.2%) | Medicare Tax (1.45%) | Federal Income Tax (18%) |

| $0 | ($62) | ($14.50) | ($180) |

| Take Home Pay = $743.50 | |||

With BENCOR

| John’s Gross Pay: $1,000 | |||

| Retirement Savings | Social Security Tax (6.2%) | Medicare Tax (1.45%) | Federal Income Tax (18%) |

| $75 | N/A | ($14.50) | ($166.50) |

| Take Home Pay = $744 + Retirement Savings = $75 | |||

FICA Alternative Plan Benefits for Eligible Employees:

- 7.5% of employee wages are contributed on a pre-tax basis

- A personal retirement account that you may not otherwise have

- Investments may be self-directed to meet individual objectives

- Greater control over retirement funds upon termination, death, disability or normal retirement age

- Increased account value due to deferred income tax payments on contributions and plan earnings